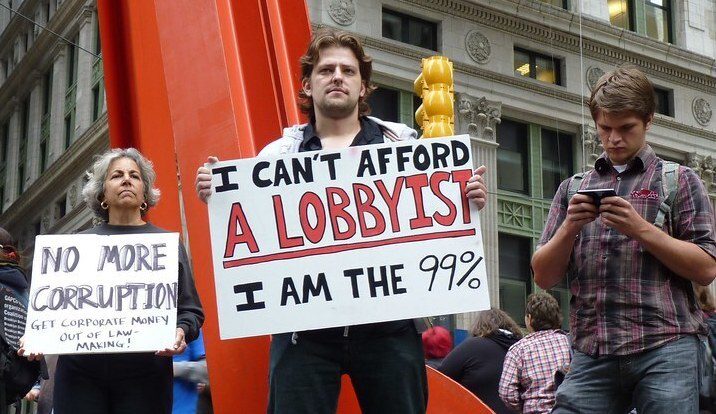

Could banning stock buybacks prevent big corporations from corrupting politicians through lobbying?

Banning stock buybacks would likely weaken the financial incentives for certain types of lobbying. However, it is unlikely to stop corporate corruption entirely. The relationship between buybacks and lobbying is part of a larger cycle of ‘rent-seeking.’ Corporations spend money to influence rules. These rules then allow them to extract even more money.

Here is how a ban on buybacks would—and would not—impact corporate lobbying and political corruption.

How Buybacks Fuel Lobbying

Currently, stock buybacks and lobbying often work in a “virtuous cycle” for executives, but a “vicious cycle” for the economy.

- Lobbying for Tax Breaks: Corporations lobby for tax cuts (like the 2017 Tax Cuts and Jobs Act).

- Using the Savings for Buybacks: Companies often redirect those tax savings. They should be used to build factories. Instead, the majority of that cash goes into buybacks. They do not raise wages with these savings.

- CEO Windfall: CEO pay is tied to stock price. It is also tied to Earnings Per Share (EPS). As a result, the buyback increases the CEO’s personal wealth.

- Reinvesting in Lobbying: A portion of that increased personal and corporate wealth is reinvested into more lobbying. This is done to secure the next tax break or regulatory loophole.

Banning buybacks would break this specific link. If a CEO cannot easily “harvest” a tax break through an immediate stock pump, the ROI becomes less certain. This makes the return on investment less predictable. It is then less predictable to lobby for that tax break.

The “Rent-Seeking” Problem

Even without buybacks, corporations have many other reasons to corrupt the political process. This is known as Rent-Seeking—seeking to increase one’s share of existing wealth without creating new wealth.

| Lobbying Goal | Would a Buyback Ban Stop This? | Why? |

|---|---|---|

| Tax Loopholes | Partially | Reduces the “fast cash” exit via stock price manipulation. |

| Subsidies | No | Companies still want direct government cash for “projects.” |

| Regulatory Capture | No | Companies will always lobby to weaken competitors or lower safety standards to save costs. |

| No-Bid Contracts | No | Selling products to the government is “productive” revenue, even if the contract was won through corruption. |

Where the Money Would Go Instead

If buybacks were banned, the massive pools of corporate cash wouldn’t just disappear. They would likely shift into other forms of political and financial influence:

- Increased Dividends: Companies might just pay out the cash as dividends. While more transparent, the wealthiest shareholders (who often fund political campaigns) would still receive the cash.

- M&A (Mergers and Acquisitions): Instead of buybacks, companies might use the cash to buy out competitors. This leads to monopolies, which give corporations even more power to dictate terms to the government.

- Dark Money: Corporations might simply move the “excess” cash into 501(c)(4) “social welfare” organizations. These organizations, known as Dark Money, can influence elections more aggressively. This ensures that whoever is in power won’t bring back the buyback ban.

The 1982 Lesson: Why it was Banned Before

Before 1982, when buybacks were effectively illegal, corporate lobbying still existed, but it was often focused on industrial policy (e.g., lobbying for trade protections or infrastructure).

Today’s lobbying is heavily financialised. It’s about changing accounting rules, capital requirements, and tax rates. Banning buybacks would likely force corporate lobbying to return to these “real world” issues. These issues, while still prone to corruption, are at least tied to the actual operation of the business. They are more genuine compared to pure stock market manipulation.

Key Takeaway: Banning buybacks is a tool to stop Value Extraction. However, it is not a substitute for Campaign Finance Reform. To stop the corruption of politicians, campaigns must be funded differently. To stop the hollowing out of companies, buybacks must be addressed.